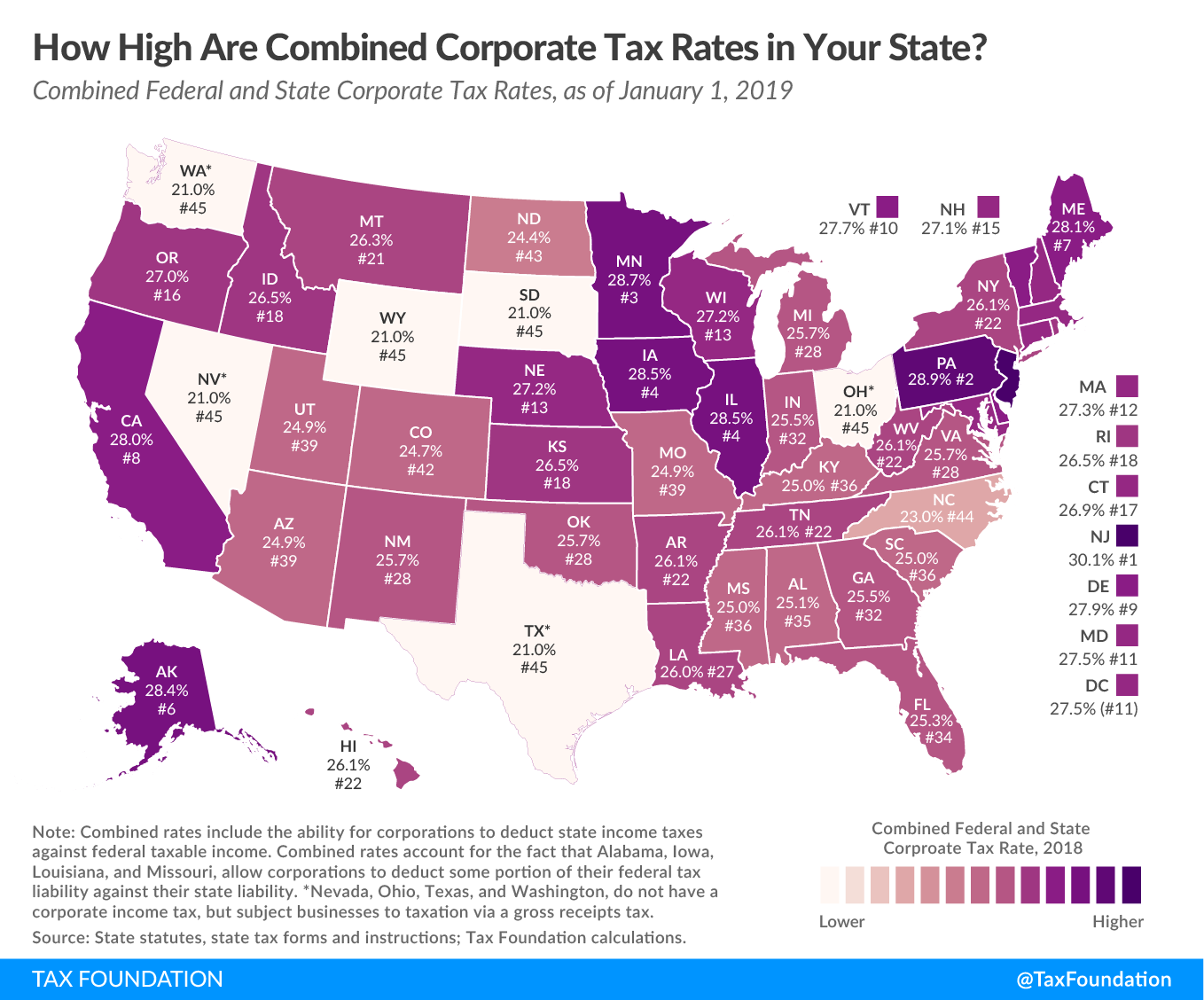

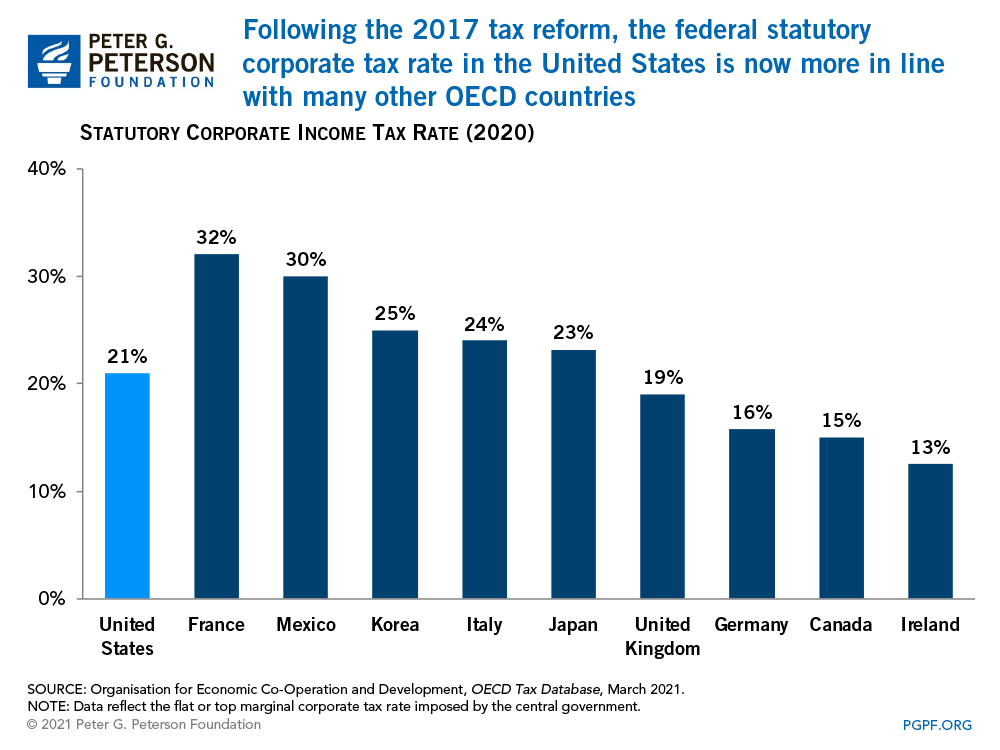

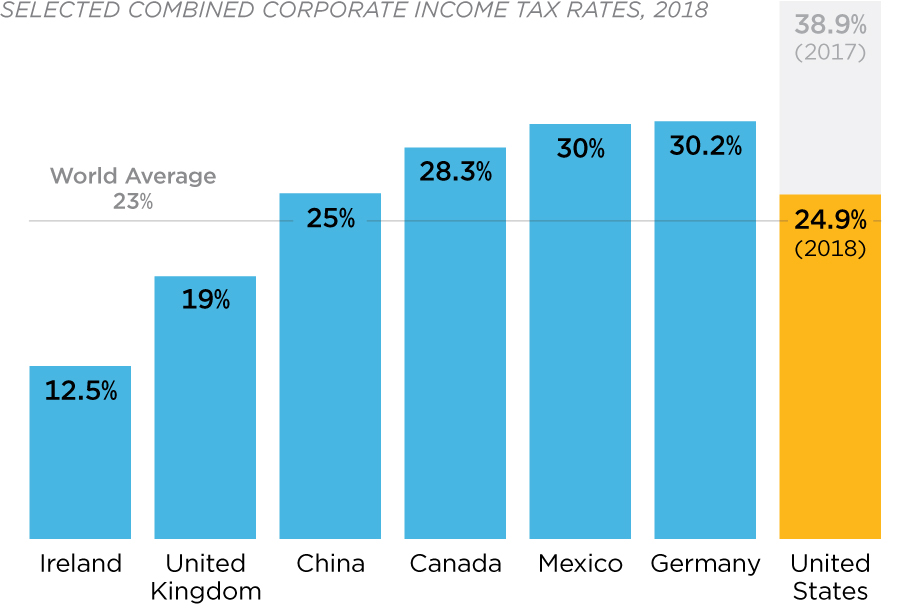

Tax Foundation on Twitter: "President Biden's #AmericanJobsPlan would increase the federal corporate tax rate to 28%, which would raise the U.S. federal-state combined tax rate to 32.34%, higher than every country in

Tax Foundation on Twitter: "A higher U.S. corporate tax rate would also exacerbate the current double taxation of corporate income. When accounting for both levels of tax, under current law, corporate income

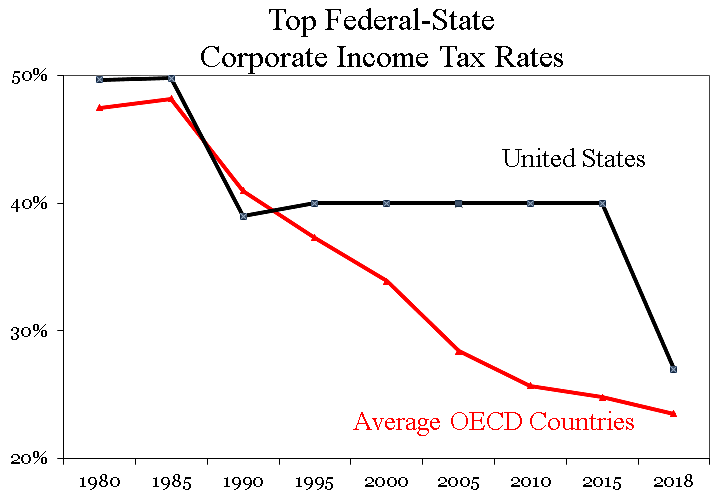

Taxes on Corporate Profits – Low, Falling for Decades, And Now Close to a Voluntary Tax | An Economic Sense

The Incredible Shrinking Corporate Tax Rate Continues to Hit New Lows for These Business Giants | Fortune

:max_bytes(150000):strip_icc()/dotdash_Final_Countries_with_the_Highest_and_Lowest_Corporate_Tax_Rates_Nov_2020-02-2d1d9e3a2450426893a7cb627c44baf9.jpg)